What are you waiting for?

Ever since the middle of 2022 we’ve heard the same from prepared homebuyers like you. That you’re waiting for the right opportunity to buy at the right time. It’s 2026, around four years have passed, and you’re still waiting. Let’s talk about what has happened while you were waiting and if any of the reasons why you waited happened.

Has the market crashed?

No. Despite news stories of increases in foreclosure rates and some markets experiencing some pricing adjustment. Markets have not crashed. In September 2025, (the most recent data at time of writing), one in every 3,997 homes was in the foreclosure process nationwide. Or 0.025% of total homes. In Utah the total number of homes in foreclosure was 908. And the number of foreclosures in Utah declined between Q2 of 2024 and Q3 of 2024,

A true housing market crash cannot currently happen because there continues to be a worsening housing shortage in Utah and most of the nation.

How did rates change?

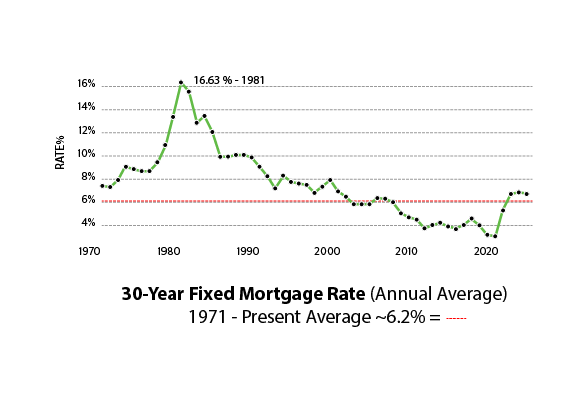

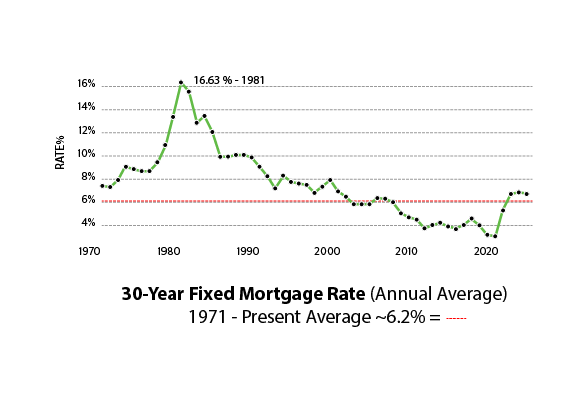

According to Mortgage News Daily, the highest average Mortgage Rate over the last four years was about 8.03% in 2023. Throughout most of 2024 and 2025 Mortgage Interest Rates have stayed steadily in the 6s. Currently back to where we were when people started to wait. Or a little bit higher. There is very little reason for most economists to believe that mortgage interest rates will go down much further this year. Uncertain economic conditions and rising costs from tariffs and other policies will continue to disrupt costs of labor, materials, and may even cause interest rates to rise in order to combat inflation.

According to Mortgage News Daily, the highest average Mortgage Rate over the last four years was about 8.03% in 2023. Throughout most of 2024 and 2025 Mortgage Interest Rates have stayed steadily in the 6s. Currently back to where we were when people started to wait. Or a little bit higher. There is very little reason for most economists to believe that mortgage interest rates will go down much further this year. Uncertain economic conditions and rising costs from tariffs and other policies will continue to disrupt costs of labor, materials, and may even cause interest rates to rise in order to combat inflation.

We would also like to take this moment to remind you once again, you’re not the only one waiting. When interest rates do improve significantly, you could be dealing with a competitive market again. Where prices will increase to meet demand.

How did your situation change?

If you’re renting, how much have you paid your landlord these past four years? To keep it simple let’s say your rent has been on average $1,800 a month over that time. While you were waiting you put $86,400 in your landlord’s bank account. While they’re also still gaining equity, and you’re getting nothing but older.

If you currently own a home. Those things that you hated about your current house four years ago are still there. Or worse. The reasons you wanted to move still exist. And haven’t gotten better.

What about incentives?

Over the course of these four years Garbett Homes has offered various incentives. From temporary mortgage rate buydowns, an allowance to be used any way you want and completed basements on select homes. All while you have continued to wait. We continue to offer market appropriate incentives on select quick move-in homes. Well informed homebuyers will have noticed that builders have drastically lowered pricing in some areas to counter housing affordability due to percieved higher interest rates, making them hundreds of thousands of dollars lower than when we had buyers camping in front of models hoping to build their dream home. Pricing will go up as interest rates go down and demand returns. That hasn’t changed. And neither has where you lived.

So if you’re able to buy and have been waiting since 2022? Why? The most that has changed is that four years have passed. Buy Now!

Are you ready to go green?

Fill in the form below and one of our team members will contact you soon to help you on your way.